Author: Golem(@web 3_golem), Odaily Planet Daily

Original Title: The Biggest Airdrop for Crypto People Is Given by Yuanbao

"xxx has sent you a cash red envelope!"

After Yuanbao's cash red envelope activity began on February 1st, many long-dead project/research exchange groups completely transformed into "grab Yuanbao wool" mutual aid groups.

For crypto people, switching from being esteemed crypto traders to wool parties grabbing Yuanbao red envelopes is also a helpless move.

Starting from January 31st, global financial markets plummeted. Precious metals, which had previously surged, quickly crashed. Spot silver nearly erased its yearly gains, and spot gold once fell below $4500. The crypto market wasn't much better. On February 2nd, Bitcoin broke below the $75,000 support level, touching a low of $74,604. ETH fell to a low of $2157.14, and SOL even fell below $100, touching a low of $95.95.

According to Coinglass data, the crypto market's total liquidation amount reached $2.5615 billion on January 31st, setting a record for the highest single-day liquidation volume since the "10.11 crash." Therefore, "too亏损到不想说话 (losing so much I don't want to talk)" became the true psychological state of many crypto people (like the silent Yi Lihua).

For crypto people who just experienced a bloodbath, grabbing Yuanbao red envelopes, though a drop in the bucket for recouping losses, can provide some psychological comfort, temporarily escaping the harsh market reality.

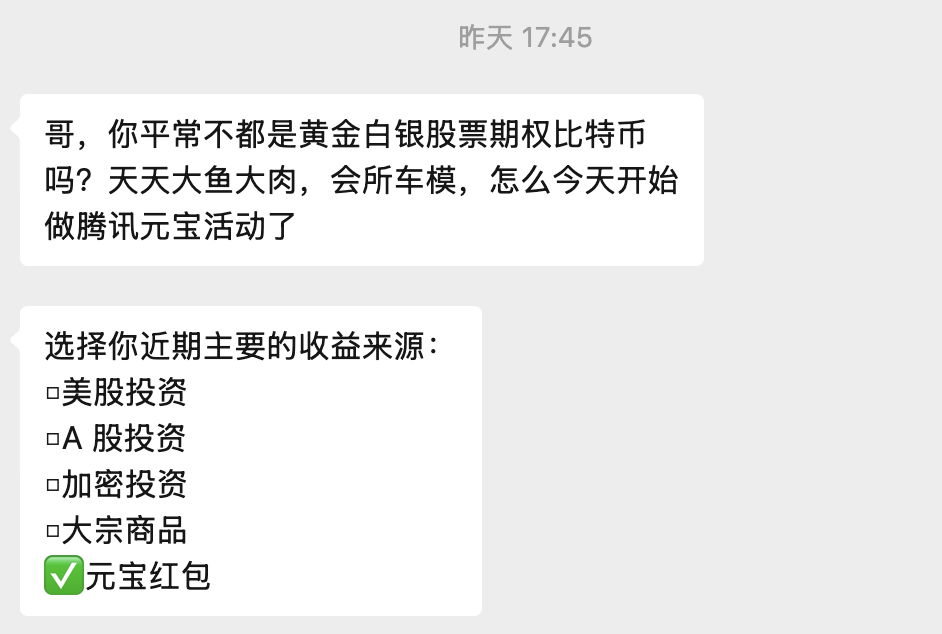

Joke in group chat

Crypto Airdrops: From Swallowing Losses Silently to Passionate Rights Protection

Saying that Yuanbao's cash red envelope is the biggest airdrop for crypto people today is not a gimmick.

The amount Yuanbao can distribute to each user in cash red envelopes is not large, mostly ranging from ten to几十 (a few tens) RMB, but its value lies in its simple interaction and truly zero cost. Users only need to spend a little time recruiting people and step-by-step experiencing product features to get cash red envelopes, with a short task cycle enabling quick returns.

In contrast, project airdrops in the crypto space are first distributed in token form. Profit is truly realized only after the tokens are sold. Although the single received amount seems much larger than Yuanbao's, after deducting time, research, opportunity, wear and tear, and potential costs of being stuck with unsellable tokens, how much is left?

A user who accompanied Infinex for 406 days deeply feels this. On January 31st, the decentralized perpetual contract trading platform Infinex announced TGE and airdrop claims. The project team successfully上岸 (made it ashore), but the community was collectively反撸 (reverse-fleeced).

一千万是只猫 (X:@RXu107) is a typical representative of being reverse-fleeced. On February 1st, he posted that he spent over $11,900 (approx. RMB 82,000) participating in this project (4400 U for NFT, 7500 U for public sale) and作为社区成员深度陪跑了 406天 (accompanied deeply as a community member for 406 days). But on TGE day, not only did he not recover his costs, but his paper loss also exceeded 100,000 RMB (2900 U + 11,284 locked INX tokens).

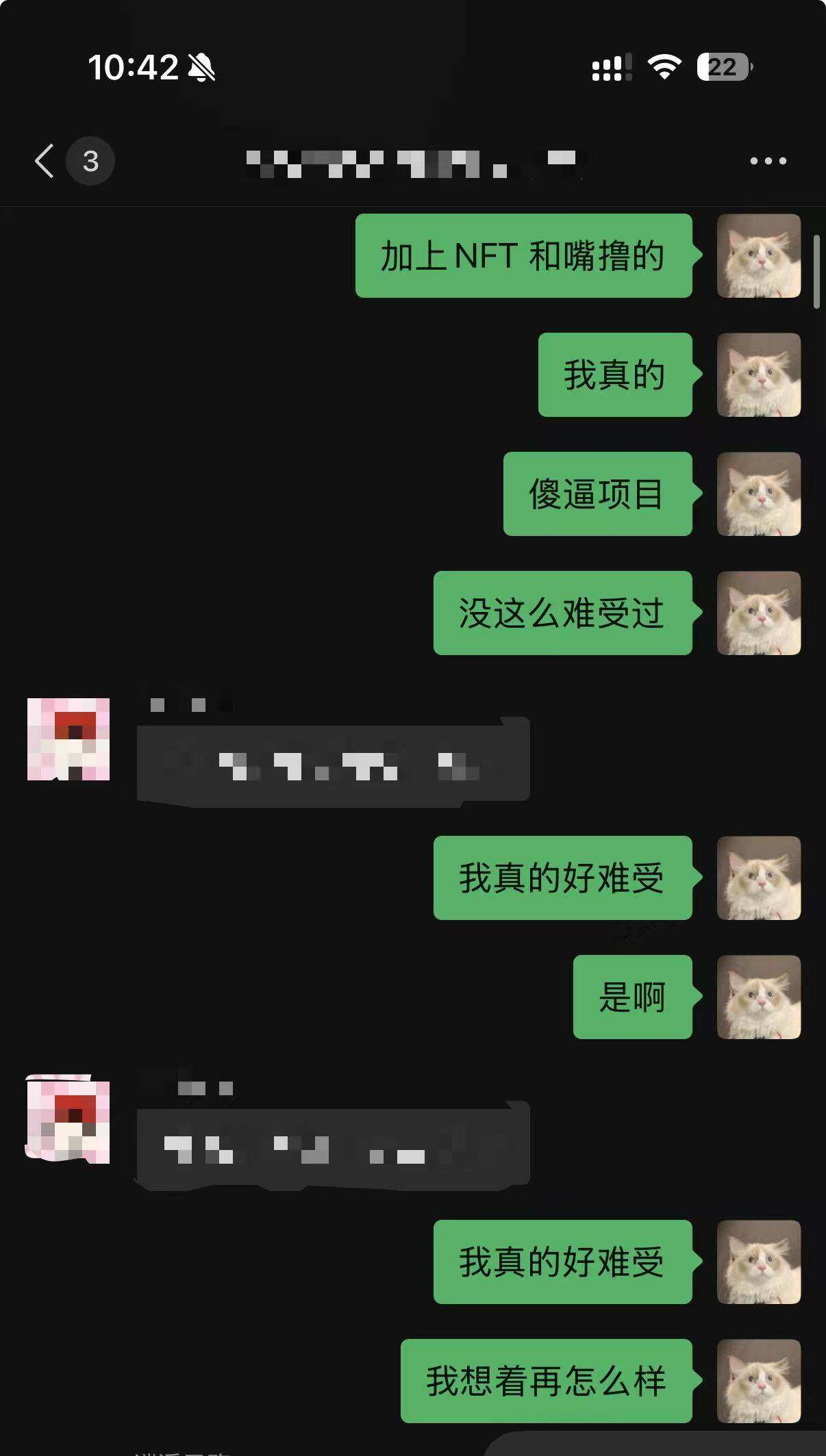

Faced with the reverse-fleece, the blogger had no choice but to repeatedly tell his friends how难受 (awful) he felt.

Blogger reverse-fleeced by Infinex tells friend he feels awful

At Infinex's TGE, the fully diluted valuation was only $150 million. The total投入 (input) for Yuanbao's New Year red envelope activity is approximately $140 million USD. What does this mean? It's equivalent to Tencent directly buying Infinex at its maximum valuation and giving it away for free to the whole nation.

Faced with the pain of being reverse-fleeced and deceived, most people in the community choose the same approach as "一千万是只猫"—swallow the loss silently. But some choose to stand up and confront the project team.

Crypto blogger Ice Frog (X:@Ice_Frog666666) is a typical representative. He started by撸毛 (wool grabbing), but ironically, in 2025, Ice Frog was either engaged in airdrop rights protection or on his way to airdrop rights protection. He is currently still negotiating with the prediction market project Space (Odaily Note: Space raised $20 million publicly, team privately took $13 million) and has even taken legal measures.

Web2 Can Afford to Deliver Airdrops, Web3 Can't Afford to Keep Promises

The most ironic point is that today's "input-reward" imbalance in crypto airdrops is not the "moral decay" of a single project, but the result of a整套行业结构变化 (complete set of industry structural changes).

In 2020, Uniswap opened the era of crypto project airdrops. Since then, there have been constant major airdrop opportunities in the crypto space. Stories of getting a car from an airdrop, swapping an airdrop for a house, or reaching A8 (wealth level) through airdrops attracted batch after batch of people into the wool grabbing track, presenting an aesthetic of "the industry is on the rise."

But by 2025, this changed. Market narratives dried up, primary financing weakened, secondary buying power was insufficient. Airdrops were no longer about sharing the future with early users, but more like mortgaging the future for present data, creating an exit path for the project team itself or换取下一轮融资窗口 (exchanging for the next financing window). Thus, major airdrops disappeared, small airdrops shrank, and "being reverse-fleeced" became the industry norm.

The so-called airdrop is just rewriting the advertising budget into a reward pool, bypassing third parties to directly establish growth relationships with users. Whether it's the 1 billion RMB given by Web2's Yuanbao or the fixed airdrop allocation in Web3 project tokenomics, the essence is this logic.

But the difference is that Web2 giants use cash to buy user certainty, while Web3 offers token returns as a promise that may be fulfilled. This results in the same tactic leading to two different destinies.

The certainty of Yuanbao's cash red envelopes comes from cash flow and约束机制 (binding mechanisms). Tencent's strong cash flow determines that Yuanbao "can pay out." The binding mechanisms under mature laws determine that Yuanbao "cannot renege." Coupled with the "simple and brainless" barrier-free interaction, users naturally understand it as a "welfare."

In contrast, crypto people not only付出 (pay) costs several times higher than Web2 wool grabbing (e.g., capital, time, energy) but also worry about being sybil attacked, token lock-up periods, and ever-changing airdrop rules. The most ironic thing is that the收益 (returns) obtained in the end are not as good as Yuanbao's.

Therefore, today's crypto airdrops have long degenerated from direct growth rewards into promises with constantly deferred fulfillment, or even unfulfilled promises. If this situation does not change in 2026, the user retention rate will be sacrificed along with it.

From User Growth to Retention, Airdrop Utility Can Only Support the First Half at Most

Using airdrops for user growth has always been the most common and direct means in the business world to deal with strong competitors.

Tencent invested 1 billion RMB cash to support Yuanbao because its competitor Doubao is strong enough. By the end of 2025, Doubao was the first AI product in China to exceed 100 million daily active users. The same goes for Web3. In the prediction market track, Polymarket dominates. To grab users, Opinion, predict.fun, and Limitless also use points airdrops for user growth, directly pulling users into the product.

In the short term, airdrops can indeed create a huge user influx entry point. But in the long run, what determines user retention is still product-market fit, user experience, and ecological linkage. In Web3's business history, there are no shortage of project cases that were bustling before the airdrop but became deserted afterwards. Therefore, both Web2 and Web3 face the same "post-airdrop problem": how to retain users.

Ten years ago, Tencent, a company good at imitating first and then surpassing, used "WeChat Red Envelopes" to push WeChat Pay into a national-level入口 (entry point), proving its extreme familiarity with the "user growth → retention → habit" chain. Whether they can create another miracle for Yuanbao in the same way is still debated, but they at least have ample experience in "how to convert airdrops into retention."

To this end, Odaily Planet Daily contacted a certain Yuanbao insider and asked from a product perspective how Web3 project airdrops should be improved. The answer was very practical:

"As one of the internet companies with the largest market capitalization, Web3 projects may not have direct references from Tencent. But the core of user growth methods like airdrops is still to improve retention. This requires a series of联动 (linkages) after the airdrop. For example, PR and marketing need to think about how to further spread the玩法 (gameplay/mechanics). The product side also needs to make more moves to achieve this."

From the perspective of Web3 practitioners,只聊流量玩法终觉浅 (only discussing traffic tactics feels shallow in the end). What product features, beyond the token, can actually retain users is更值得推敲 (more worth scrutinizing).

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Exchange Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush